35+ Mortgage rate comparison calculator

Instant rate change notifications. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

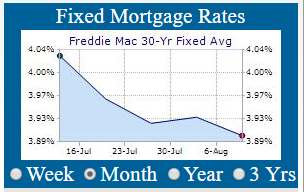

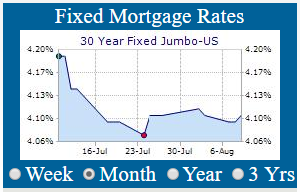

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

. Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. The whole of market MSE mortgage best buys tool allows you to find the cheapest rates fees for fixed variable and more mortgages.

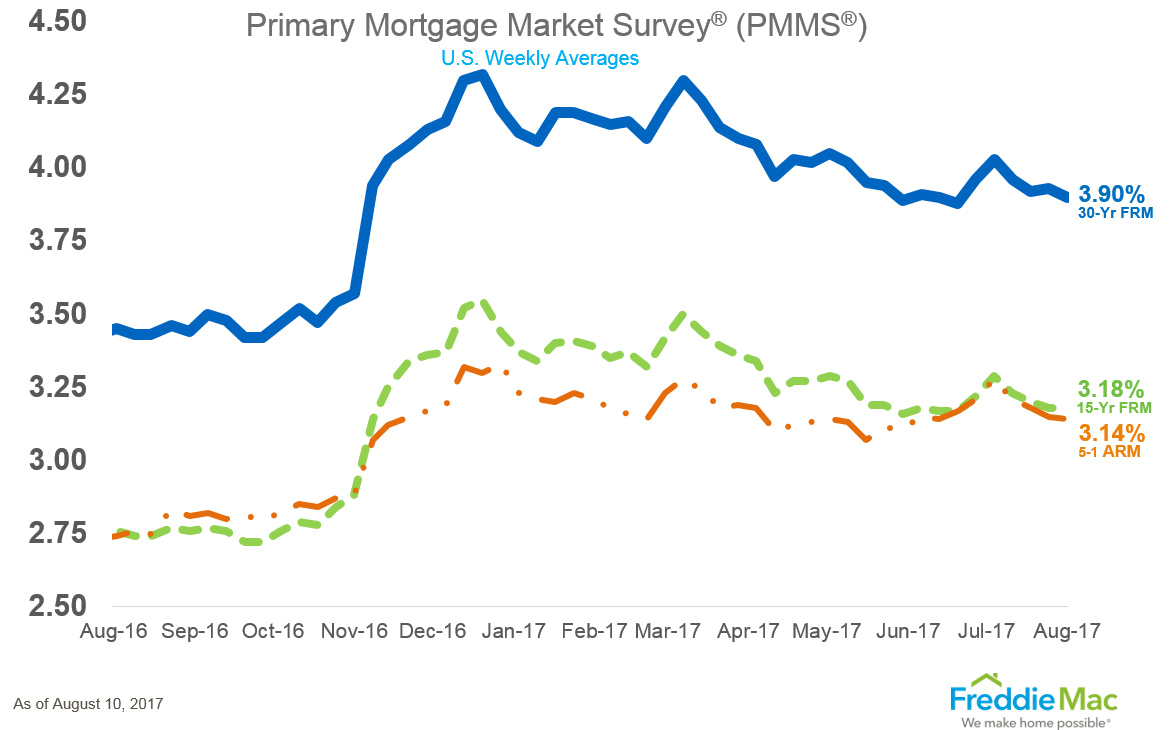

It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. Mortgage rate loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest.

Monthly payment 381. A mortgage is one of the biggest commitments youll make in your financial life. For example if a mortgage rate is 6 APR it means the borrower will have to pay 6 divided by twelve which comes out to 05 in interest every month.

Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal. Youll receive a fixed rate of 1499 pa. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

People typically move homes or refinance about every 5 to 7 years. The mortgage amount rate type fixed or variable term amortization period and payment frequency. Refinance your mortgage - Refinance is another option if the mortgage rate has declined since you bought your house.

Plus full QA incl full info on stamp duty holiday up to 500000. In the above A vs. But with so many possible deals out there it can be hard to work out which would cost you the least.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Build home equity much faster. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

See how your monthly payment changes by making updates to. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Initial rate 198.

A P i10012 1 - 1 1. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided.

The upfront guarantee fee is 1 of the loan amount while the annual guarantee fee is 035 of the outstanding principal balance. You will get a comparison table that compares your original mortgage with the early payoff. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

Please get in touch over the phone or visit us in branch. Lets calculate the monthly payment on a 500000 30-year fixed mortgage with a 5 interest rate. With a comparison rate of.

If a person. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Texas also increased its total population by 27. Track live mortgage rates.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Mortgage Payment w Amortization Mortgage Loan Comparison Early Payoff. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Fixed Rate Mortgage Loan Calculator. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

A chattel mortgage calculator comes up with a repayment amount based on the information you provide using basic arithmetic. Costs Associated with Home Ownership and Mortgages. The annual fee is also paid for the.

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey

Using Pv Function In Excel To Calculate Present Value

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

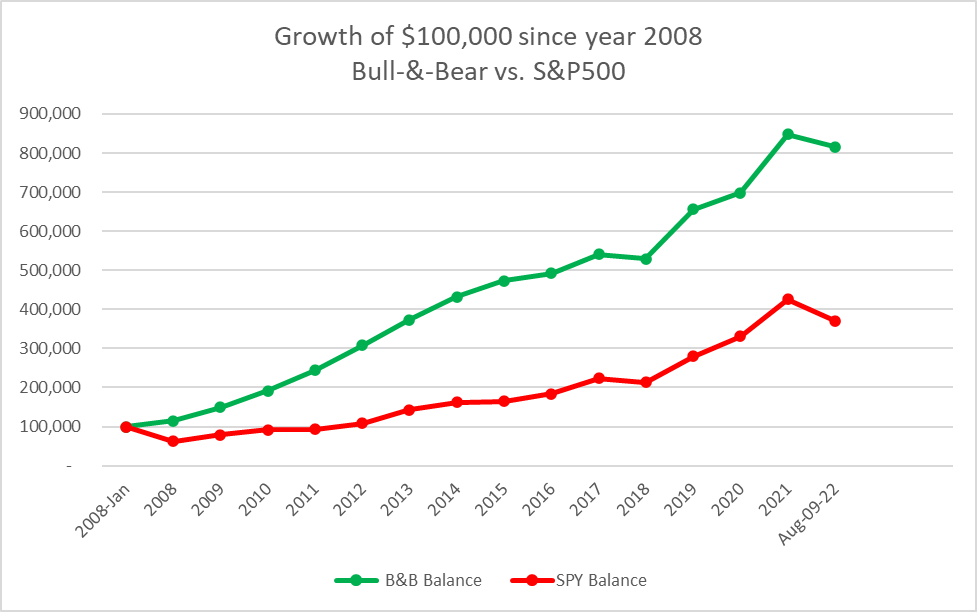

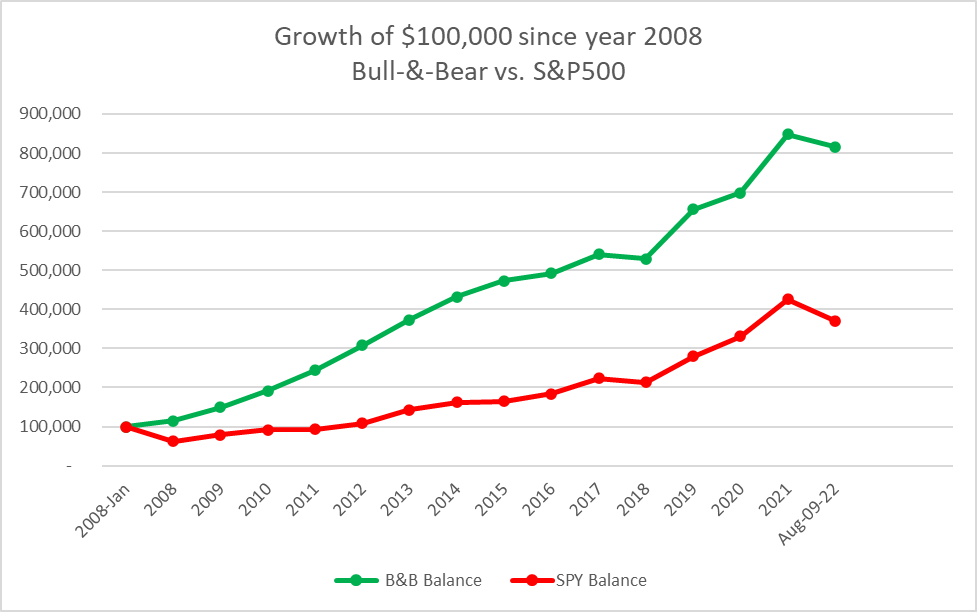

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Why Is It Smart To Start Saving For Retirement When You Re In Your 30s Quora

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Your Adjustable Rate Mortgage Needs To Be Refinanced

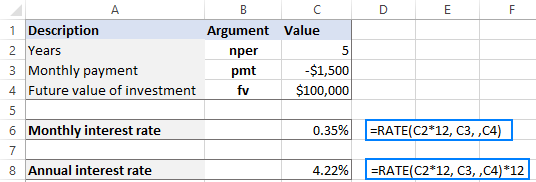

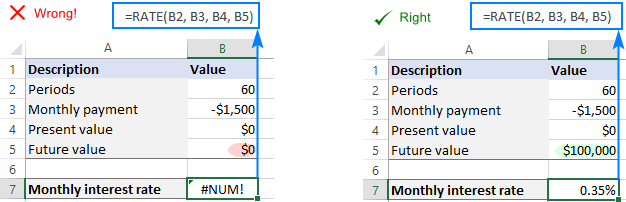

Using Rate Function In Excel To Calculate Interest Rate

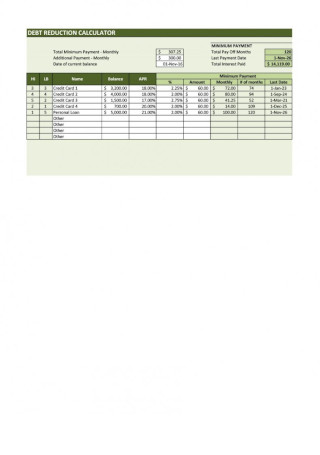

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Using Rate Function In Excel To Calculate Interest Rate

Your Adjustable Rate Mortgage Needs To Be Refinanced